The Mid-Atlantic’s coastal region is susceptible to storms and hurricanes, which creates additional risk for insurers, and more difficulty securing coverage. Extreme weather events — such as hurricanes, tornadoes, hailstorms and wildfires — continue to make headlines as they become increasingly devastating and costly. These events aren’t limited to one geographic area, impacting businesses across the United States. According to industry data, natural disasters cost the global economy $227 billion in 2022, with under half of those expenses ($99 billion) covered by insurers.

This marks the third consecutive year in which natural disaster losses exceeded $100 billion. Breaking down this number, the National Centers for Environmental Information recorded 15 separate weather and climate events with losses exceeding $1 billion across the country in 2022. Many weather experts believe such events are the new norm.

According to Martin Bertogg, head of Catastrophe Perils at Swiss Re, “Urban development, wealth accumulation in disaster-prone areas, inflation and climate change are key factors at play, turning extreme weather into ever-rising natural catastrophe losses.” Looking ahead, associations and businesses can expect to encounter additional emphasis on weather readiness and risk mitigation efforts from insurers.

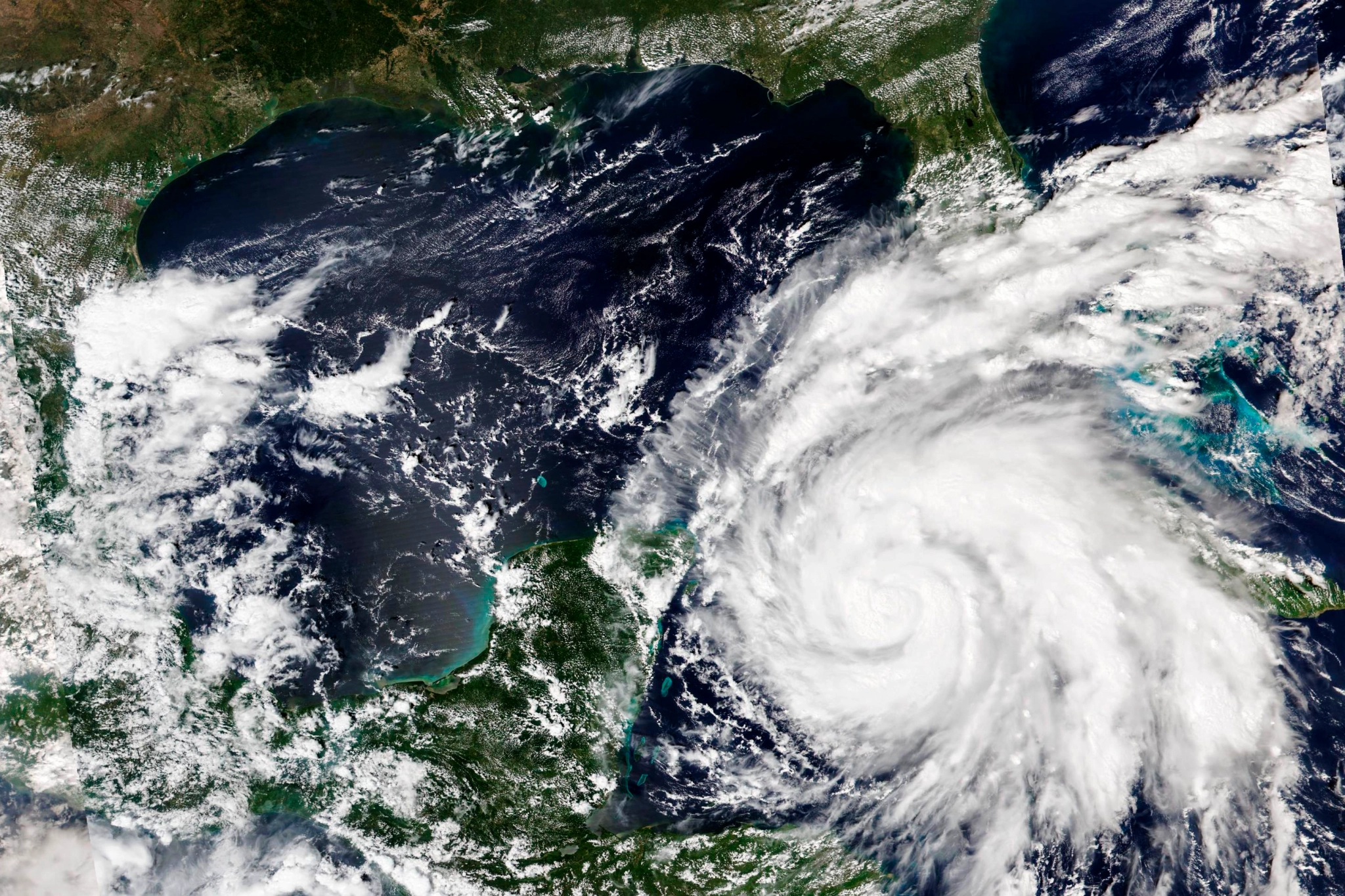

Florida’s Catastrophic Year

Hurricane Ian caused widespread damage and took a toll on Florida’s disaster insurance infrastructure. Wind-damage losses from the storm are expected to be between $22 billion and $32 billion for residential and commercial properties. Storm-surge damage may potentially add another $6-$15 billion to the ticket price. Overall, lan could be responsible for an estimated $60 billion dollars in losses.

The storm is considered the second-largest U.S. catastrophe loss on record. Only Hurricane Katrina, which hit the country with $90 billion in losses in 2005, out-shadows lan’s damage, according to Mark Friedlander, director of corporate communications at the Insurance Information Institute.

Tricky Predictions

When setting premiums, insurance carriers model losses based on factors such as population and disaster risk, but it can be hard to predict certain things in such a swiftly changing environment. “It’s hard to factor in the cost of raw material, such as lumber, when the cost of labor is so much more expensive,” Masi says. “A claim that might have been paid $500,000 may now cost a company $1 million.”

Taking Steps to Be Sure

There are steps you can take today to prepare your community for harsh weather events and help control the impact on your premium.

- Review Property Values due to rising inflation

- Review Procedures on how claims are handled

- Review and circulate regular communication with homeowners on what is their responsibility to insure and maintain

- Review and circulate regular risk management recommendations on winterization, dryer vent cleanings, hot water heater replacements and other risk management techniques.

- Procure and follow recommended maintenance and replacement outlined in a Reserve Fund Study

Reach out to the coastal insurance experts at Deeley Insurance for help with your Master Policy, unit owner’s coverage and beyond. 410.213.5600. With Deeley, you can Be Sure.

Compiled from articles by Hazel Siff, CAI and L.S. Howard, InsuranceJournal