Directors and Officers (D&O) insurance helps protect community association leaders against claims alleging wrongful acts tied to board decisions and governance. Coverage commonly applies to board members, committee members, and, in some cases, the association itself.

D&O protects the insured against claims for wrongful acts.

Insured: Association, Directors & Officers, Committee Members, Volunteers, Management Company

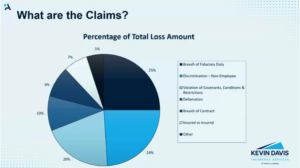

Claim:

- Written demand for monetary/non-monetary relief

- Civil or criminal proceedings or formal administrative proceedings.

Wrongful Act:

- Failure to act

- Breach of fiduciary duty

- Error or mistake

- Duty of care: Board members must make informed, reasonable decisions, relying on appropriate experts when necessary.

- Duty of loyalty: Board members must act in the association’s best interest and avoid conflicts of interest or self-dealing.

- Duty of obedience: Boards must follow governing documents, established procedures, and applicable laws.

- Disputes over elections, meeting notices, or record access

- Selective enforcement allegations (or the appearance of it)

- Architectural approvals and denials that upset owners

- Vendor and contract decisions challenged by members

- Budget choices, special assessments, or reserve handling questioned after the fact

Ways to Reduce Claims:

- Consistent Rule Enforcement

- Document Decisions

- Follow Governing Documents

- Seek Legal Advice Early

- Avoid Emotional Decisions

Be Sure you’re protected!

Reach out to the Community Association Insurance experts at Deeley Insurance Group today. Call or text 410.213.5600.