For over a decade, rising claim frequency and severity have diminished underwriting profitability and generated hardened conditions across the commercial auto insurance segment. Key factors contributing to these market difficulties include surging accident expenses, costly litigation and increasingly unsafe driving habits among commercial drivers. Consequently, the vast majority of policyholders have encountered significant rate hikes for several years.

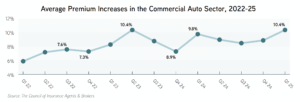

In the final quarter of 2024, industry experts reported that average premium increases reached 8.9%, up from 8.5% in the previous quarter. The first half of 2025 has been much of the same, with average rate jumps hovering just above 10%. Insureds with additional exposures (e.g., large fleet size and poor loss history) have been particularly susceptible to higher premium expenses and limited capacity.

Current Market Trends and Cost Drivers

Although technological advancements have helped improve vehicle safety and efficiency, they are also more expensive to repair after collisions on the road. This, in turn, has led to rising overall accident costs and associated insurance challenges, especially for commercial fleets outfitted with sophisticated components. Making matters worse, various tariffs recently imposed by the United States, namely those for imported vehicles and parts, have the potential to cause supply chain disruptions and further inflate repair costs and related accident losses. Commercial auto insurers will likely respond to these concerns by reassessing their pricing structures.

Besides elevated accident expenses, litigation remains a major cost driver in the commercial auto insurance segment. In particular, social inflation—the rising cost of insurance claims influenced by societal trends—has persistently fueled an increase in third-party litigation funding (TPLF). This financing mechanism has enabled more frequent and aggressive lawsuits against fleet operators for their alleged wrongdoings, primarily following fatal accidents. As a result of TPLF and related litigation, nuclear verdicts, which refer to jury awards exceeding $10 million, have become more prevalent. According to the American Transportation Research Institute, such verdicts have doubled in the trucking space over the past decade. As these litigation issues persist, a growing number of commercial auto insurers have decreased their risk appetites by reducing their coverage offerings, while others have exited the market altogether, leaving many insureds with limited protection.

In recent years, there has also been a rise in unsafe driving habits among commercial drivers, prompting additional accidents and related insurance expenses. Distracted driving—mainly texting, adjusting the radio and eating behind the wheel—is an especially dangerous habit. The latest data from the National Highway Traffic Safety Administration revealed that distracted driving caused nearly 3,300 deaths and 325,000 injuries on the road in 2023, contributing to 8% of police-reported fatal crashes and 13% of total traffic crashes. Furthermore, certain forms of distracted driving (i.e., texting) are illegal in most states. As such, policyholders facing distracted driving losses are prone to heightened commercial auto claim costs and considerable regulatory ramifications.

Looking Ahead

Moving into the second half of 2025, these trends will likely keep the commercial auto insurance segment in a hardened state, with insurers deploying ongoing rate increases for the remainder of the year. While these unfavorable market conditions should affect nearly all policyholders, those with poor risk profiles can expect to encounter more severe challenges, including double-digit premium jumps, minimal capacity and tightened coverage terms. Insureds with documented driver safety programs and accident prevention measures will be best positioned to navigate this evolving risk landscape. In some cases, policyholders may also benefit from reviewing offerings in the excess and surplus market and exploring alternative risk transfer solutions to minimize potential coverage gaps.

Contact Delmarva’s Insurance Experts at Deeley Insurance Group for additional market updates and resources. Call or text 410.213.5600 and Be Sure.