Insurance Resolutions for 2026

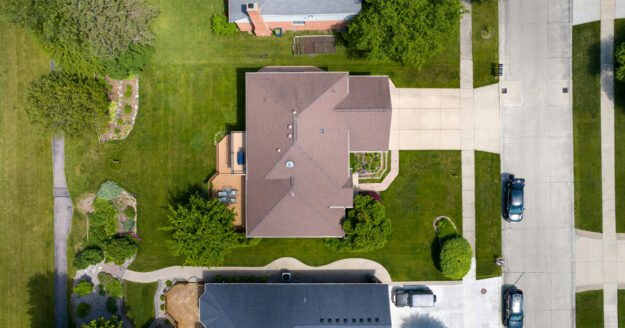

These Insurance Resolutions will help you start the New Year smarter and safer! Check in with Life Changes New house? New spouse? New baby? New teen driver on your policy? Let us know! Consider Your Holiday Goodies If you purchased or received new valuables – a new vehicle, jewelry, coat, art or collectibles – reach…